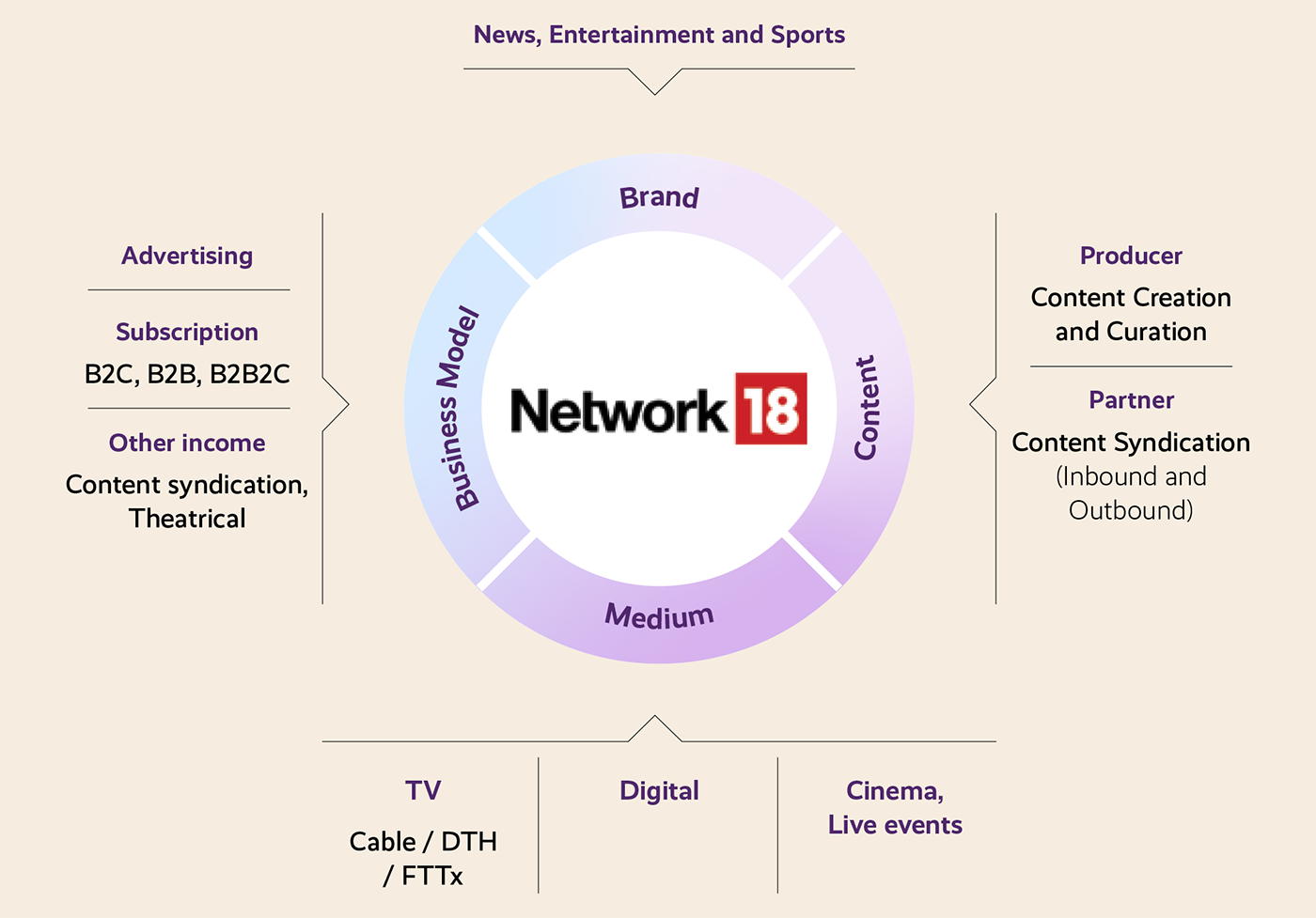

Network18 Media & Investments (Network18) is one of India’s most prominent Media & Entertainment conglomerates. With a 3600 presence across content genres including news, entertainment, sports, movie production, and live entertainment, it is a one-stop-destination for audiences seeking diverse content.

The company’s focus on delivering authentic news and wholesome entertainment content that resonates with audiences across demographics and socio-economic segments has helped it build a unique connection with its viewers. Our content is agnostic of distribution channel and consumption platform, reaching out to consumers wherever they are present. To maintain its position as a leading player in the media industry, Network18 continues to invest in creating quality content, expanding its reach, and creating partnerships with players across the media value chain.

The company is well-positioned to capture the growth opportunities presented by India’s rapidly growing and evolving media landscape.

0%

TV VIEWERSHIP SHARE (NEWS GENRE)0%

TV VIEWERSHIP SHARE (ENTERTAINMENT GENRE)0 MILLION+

DIGITAL REACH(NW18 DIGITAL PORTFOLIO)

0 MILLION+

VIEWERS ON JIOCINEMAFOR THE FINAL MATCH OF IPL

![]()

In FY 2022-23, our primary focus was on solidifying our position as the top news network and

strengthening our foothold in the entertainment sector, in the backdrop of a challenging

macro

environment. Our businesses achieved phenomenal operational success and we continued to

make investments for growth, despite the slowdown in economic activity and a weak

advertising

environment. We are confident that the investments we have made during the year have helped

us

create solid foundations which will enable us to deliver strong growth in the coming years.

VISION AND MISSION

Network18 aims to be a provider of top‑drawer content across genres, regions and languages, reaching out to audience on platforms of their choice. We seek to be India’s top media house with an unparalleled reach and touch the lives of Indians across demographic segments and geographic regions.

PORTFOLIO AT A GLANCE

COMPETITIVE MOAT

Diverse Network with Genre Defining Brands

- The only Indian M&E company with presence across all content genres – news, entertainment, sports, movies, live entertainment.

- 20 channels covering news in 16 languages and digital news platforms in 13 languages; #1 TV news channels in Hindi, English and Business News genres.

- Full-portfolio entertainment offering including 10 regional language TV channels, premium sports content, leading OTT platform, and a film studio renowned for standout cinema.

- Brands like CNBC TV18, News18, Colors, MoneyControl, MTV have a strong brand equity and are synonymous with the genres they operate in.

60 TV channels in 16 languages

Reach and Engagement

- JioCinema became India’s #1 OTT platform, reaching ~450mn users for IPL.

- 1 in every 2 Indians tunes in to Network18 television network that reaches >95% of TV homes in India, annually.

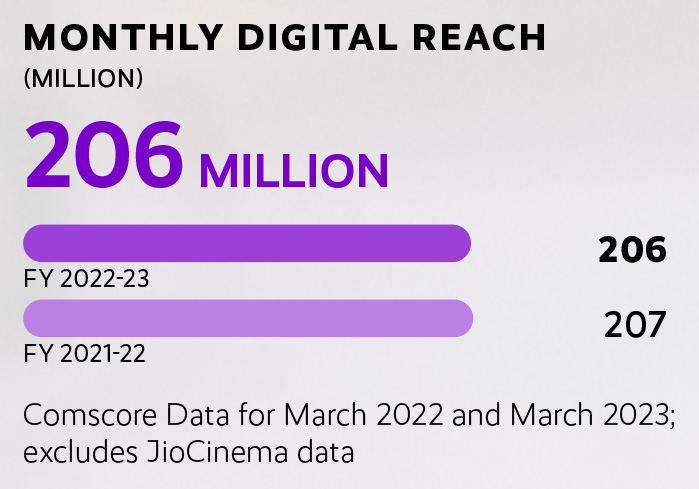

- 40% of internet users in India access Network18 websites or apps every month, making it the #2 digital news/information publisher in India, and amongst the top 10 globally.

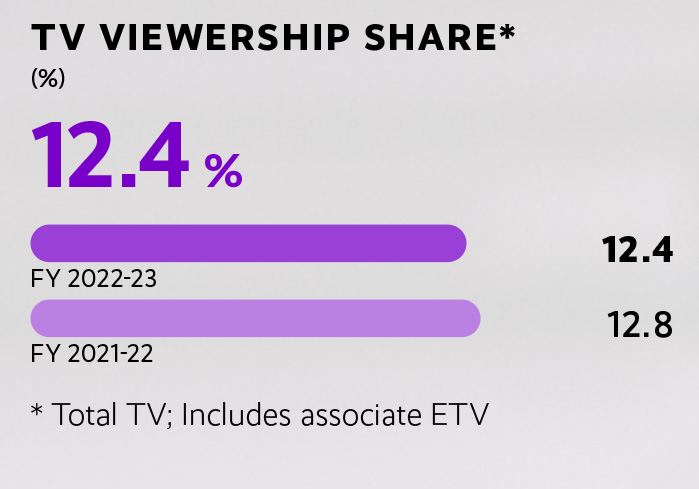

- India’s largest TV News portfolio, with 11.9%1 share of news viewership; Entertainment network enjoys a 10.3%2 viewership share.

- MoneyControl is India’s #1 financial news and information platform in terms of engagement across platforms.

JioCinema’s IPL streaming reached ~450mn users in 2 months; TV Network reaches 700mn+ every month

Strong Partnerships Across the Board

- Partnerships with leading global and Indian players to strengthen content creation and distribution capabilities.

- Bodhi Tree Systems, Paramount Global, NBCU (CNBC), Warner Bros. Discovery (CNN, HBO) A+E Networks, Forbes are among some of Network18’s global partners.

- Leading content distribution platforms like Jio mobile, Jio Fiber, Den, Hathway are part of the parent Group, enabling Network18 to have extensive reach.

- Advertisers across the country leverage Network18 platforms to reach their audience on TV, Mobiles, CTVs and other touch points.

~3,000 advertisers use Network18 platforms to reach their consumers

- 1 BARC Data: News Genre, Week 10-13’23

- 2 BARC Data: Entertainment Genre (including Sports), Week 14’22-13’23

HIGHLIGHTS

Strong Operating Performance

News

- Undisputed leadership in key markets - News18 India (Hindi), CNN News18 (English) and CNBC TV18 (English Business News) were #1 channels in their genres.

- News network reached its highest ever viewership share of 11.9%3.

- Digital portfolio strengthened its position as India’s #2 online news publisher with leadership in vernacular genre.

Entertainment

- Entertainment portfolio had a share of 10.3%4 in the genre with a strong #2 position in the Hindi general entertainment segment.

- Digital platform, Voot, continued to deliver industry leading engagement metrics and saw a strong growth in paid subscribers.

- Viacom 18 Studios delivered a strong slate of movies and shows during the year.

Sports Business Delivered a Big-Bang Performance in its First Year

- JioCinema’s coverage of IPL set new viewership records, making it the most watched digital event globally – 17 billion+ video views, 32 million+ peak concurrency, 120 million+ reach for the final match.

- Digital streaming of FIFA World Cup and Women Premier League events received accolades from consumers for high quality delivery and never seen-before features.

- Strengthened the sports catalogue with acquisition of media rights of premium properties like IPL (Digital), WPL, Olympics 2024, SA20, Moto GP.

Viacom18 Completed the Strategic Partnership with Bodhi Tree, Paramount and Reliance

- Post completion of the transaction

for strategic partnership, JioCinema

app came under the fold of

Viacom18 and Viacom18 got access

to `15,145 crore.

- The partnership enables Viacom18 to significantly scale-up its reach and make investments in growth initiatives. Viacom18 is equipped to lead disruption and innovation of the M&E sector in India.

New Content Formats for the ‘New Age’ Audience

- Firstpost Vantage, a digital-first, multi-platform show which covers world affairs with an Indian lens, was launched to cater to aspirational Indian audience.

- Local18, a platform for hyper-local, video-first coverage of news was rolled out in 250 districts across the country.

Resilient Financial Performance Despite Economic Headwinds

- Consolidated revenue grew by 6.4%, despite a slowdown in the economic environment.

- Continued investments across businesses helped build a strong foundation for growth.

4 BARC Data: Entertainment Genre (including Sports), Week 14’22-13’23; excludes ETV

INDUSTRY OVERVIEW

With 7.2% GDP growth in FY 2022‑23, India is one of the fastest growing major economies in the world. Despite the impact of high inflation due to the sharp rise in oil prices post US-Ukraine conflict as well as the disruption of global supply chains in the aftermath of the pandemic, Indian economy fared better than the rest of the world. However, consumer demand slowed down in the first half as prices of consumer goods increased to keep pace with raw material prices. The increase in lending rates in the second half also impacted the industrial growth and consumer spending power.

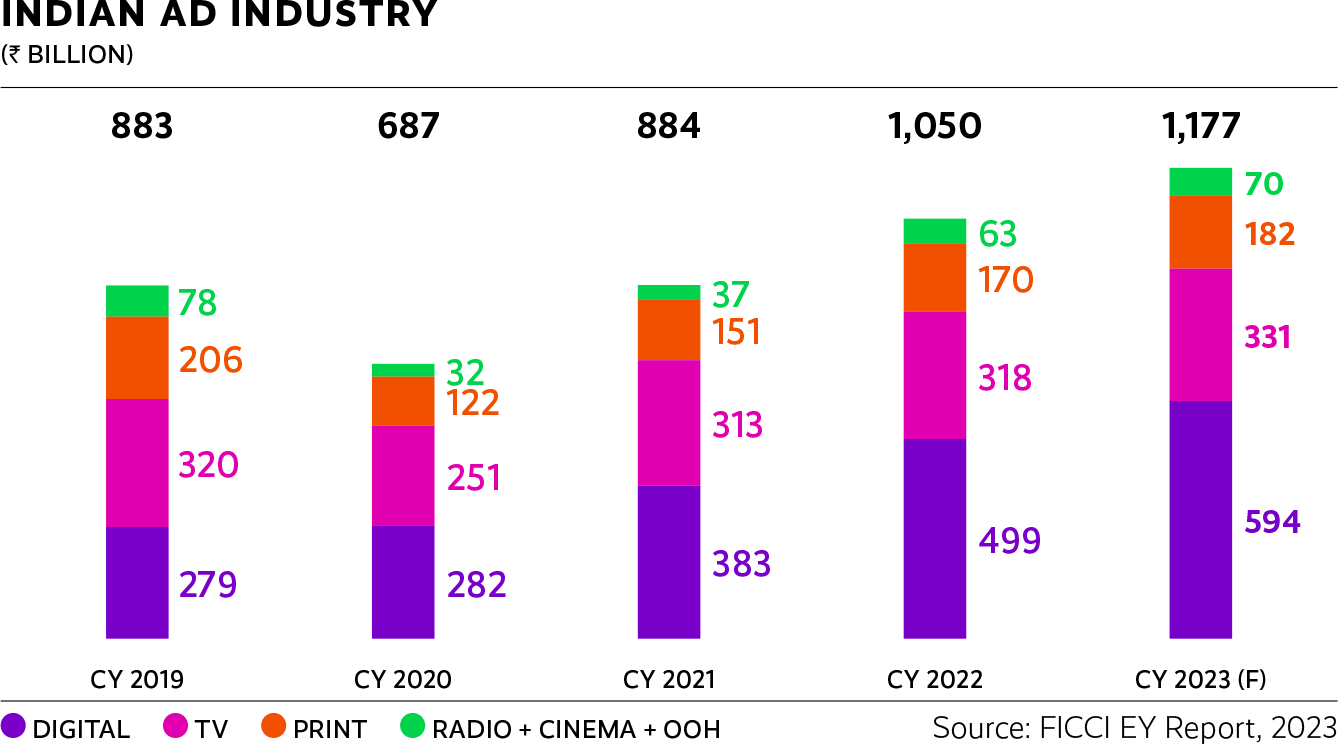

Media and Entertainment sector, being inextricably linked to the macro‑economic environment, also faced headwinds during the year. While Y-o-Y growth (CY2022 vs CY2021) was strong at ~20%, compared to pre-pandemic levels of 2019, total revenue was only 10% higher. The demand for content continued to grow as consumers increasingly spent more time on media consumption, but monetisation faced challenges on both advertising and subscription fronts. Growth during the year was driven by 30%5 growth in Digital segment. Digital advertising, including spends by small and medium sized businesses, for whom digital is often the only marketing platform due to limited budgets, commanded more than 50% share of the total ad revenues. TV’s share in the total ad pie declined by ~500 bps as the ad revenue on the medium was flat. As per various industry reports, TV and Digital are the most effective mediums for brand building and reach, capturing nearly 80% share of the total ad spends. Print continued to struggle and despite a 13% Y-o-Y growth, it remains well below the pre-pandemic levels. While cinema advertising continues to languish, theatrical revenues saw a sharp jump as consumers returned to cinemas and several movies achieved phenomenal box-office success. For CY2023, the reports forecast that the M&E industry will grow at ~12%, led by digital which is expected to grow at ~18% while TV is expected to grow at low single-digit rate.

5 Source : FICCI EY Report 2023

`1 TRILLION

AD SPENDS CROSSED THE MILESTONE IN CY2022, GROWING 19% Y-O-Y

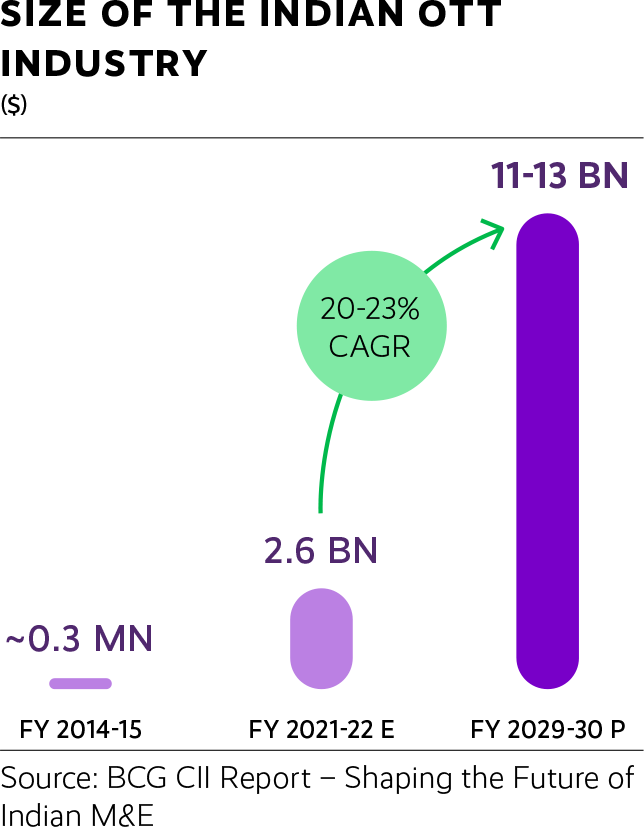

OTT Advertising and Subscription to Continue Growing

Given the secular trend of increasing smartphone and internet penetration, digital medium is expected to continue its impressive growth for the foreseeable future. Within Digital, OTT is one of the fastest growing segments as increasingly more consumers are spending time consuming content on these platforms.

As per the BCG CII Report – Shaping the future of Indian M&E, the current size of the Indian OTT market is $2.6 bn and it is expected to grow at a CAGR of 20%-23% to reach $11-13 bn by 2030. OTT provides two options to the consumer – to consume free content which is monetised through advertising (AVOD model) or watch premium content on paying a subscription fees (SVOD model).

As per the same report, India currently has 85-90mn paid subscriptions, which is expected to nearly double to 160-165mn by 2027. Bundling of subscriptions through telecom plans and emergence of aggregator platforms is also expected to aid this growth.

OTT advertising will continue to grow on the back of increasing internet-connected audience, growing time-spend and improving targeting advertising capabilities.

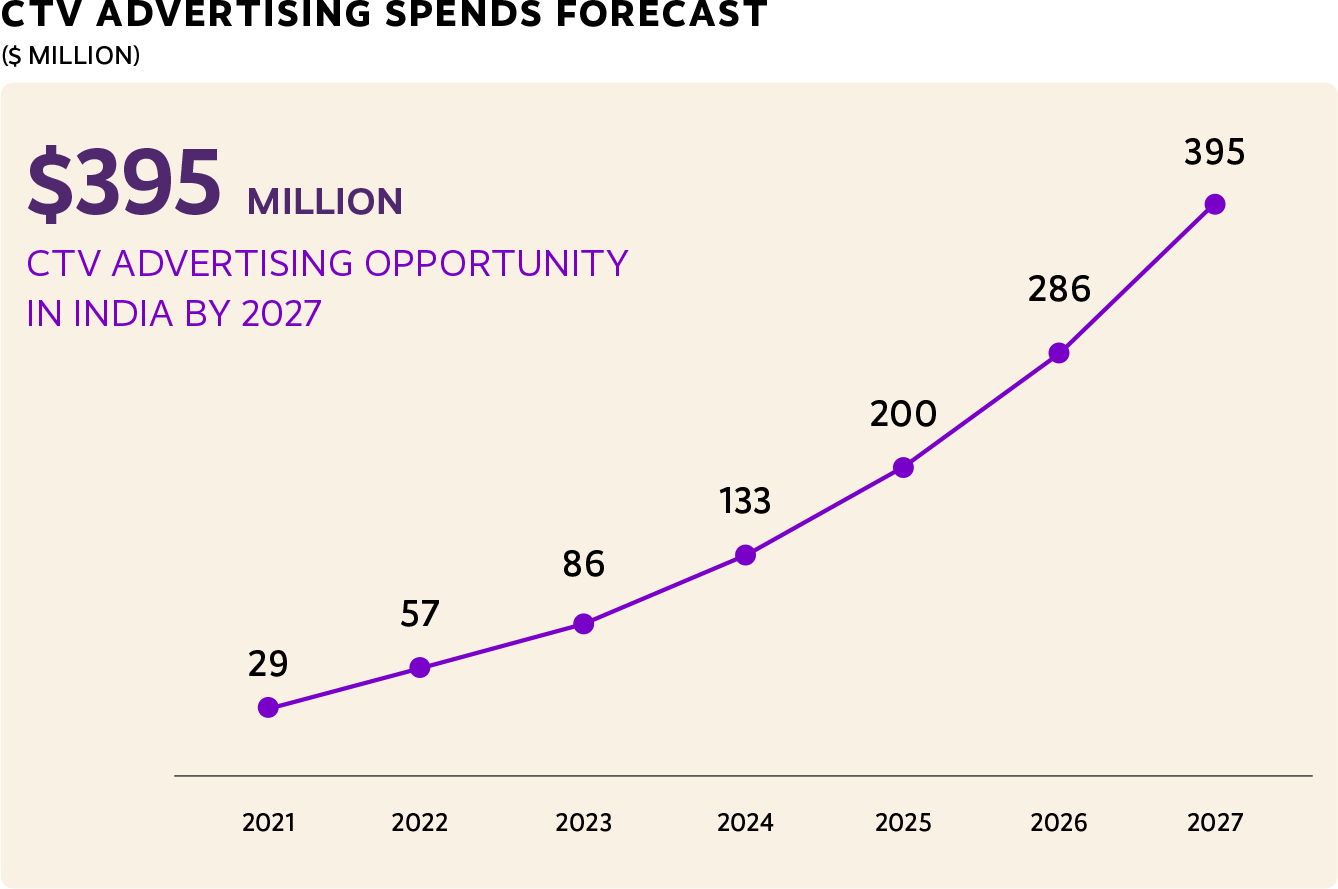

Connected TVs – A Promising Growth Opportunity

Internet-connected mobile phones have been the primary driver for the massive growth in digital content consumption, responsible for nearly 90% of this growth. However, the engagement levels on big screens (TV) continue to be much higher than handsets. Connected TVs (CTV) offer the best features of both traditional and digital eco-system – a large screen size and ability for targeted advertising, thus providing an opportunity to brands to reach premium audiences in an intelligent fashion. Due to a low penetration of CTVs, advertising on the medium is currently at a nascent stage in India, at just over 1% of total TV spends.

47%

CAGR CTV AD SPENDS IN INDIA 2022-2027

Source: Groupm TYNY Report, 2023New Tariff Order Finally Clears Legal Hurdles

After being mired in multiple litigation challenges for more than two years, the New Tariff Order was cleared for implementation after the regulatory body, TRAI, amended the regulation post an industry-wide consultation process.

The proposal to lower the price ceiling for including a channel in a bouquet to `12 was dropped, reverting to the earlier price limit of `19. Another key proposal to introduce a discount cap of 33% on the bouquet price vis a vis a-la-carte price was modified, with the discount limit increased to 45%. While a few appeals were filed against the new regulation by some distribution platforms, it was implemented in February 2023.

However, with the fast-increasing adoption of CTVs in India, it is expected that advertising spends on the platform will also follow suit. The growth in CTV revenue is also expected to be driven by subscription, fuelled by the investments in high quality digital content. This is likely to further accelerate the adoption of CTV, as viewers seek out big-screen experience for the premium content.

Key Hindi General Entertainment Channels moved out of the DD Freedish Platform

At the beginning of the year, all the major broadcasters took their FTA channels off DD Freedish distribution platform. This had an impact on viewership, up to 90% for some of these channels, as they run older content which doesn’t get much viewership on pay platforms.

Subsequently, it also impacted the ad revenue growth for these channels and the networks. However, it has helped to slow down the loss of pay-TV subscribers, an issue which has affected the industry since the implementation of the New Tariff Order (NTO) in early 2019, followed 20-23% CAGR by the pandemic a year later. Given that the quality of content on these channels is superior to most of the other content available on the FTA platform, it provides an incentive for consumers to upgrade and become pay subscribers.

EMERGING TRENDS AND BUSINESS RESPONSE

![]() Content consumption on digital

platforms is growing. With over 500

million people consuming content on

digital/OTT platforms, digital has

now become a secondary screen,

and in some cases the primary.

Content consumption on digital

platforms is growing. With over 500

million people consuming content on

digital/OTT platforms, digital has

now become a secondary screen,

and in some cases the primary.

![]() Network18 is focused on creating

digital platforms which become the default

destinations for content consumption.

The group is not only investing in content

creation for its platforms but is also

leveraging technological innovations to

provide consumers with a seamless and

unique experience on the medium of

their choice. JioCinema’s IPL streaming

reached ~450mn consumers with

innovative features, setting new reach and

engagement benchmarks. News18.com

and Moneycontrol are amongst the top

destinations for digital news audience.

Network18 is focused on creating

digital platforms which become the default

destinations for content consumption.

The group is not only investing in content

creation for its platforms but is also

leveraging technological innovations to

provide consumers with a seamless and

unique experience on the medium of

their choice. JioCinema’s IPL streaming

reached ~450mn consumers with

innovative features, setting new reach and

engagement benchmarks. News18.com

and Moneycontrol are amongst the top

destinations for digital news audience.

![]() New content forms are

emerging. From user generated

videos to short-form content to

metaverse, content creation is

seeing a wave of disruption.

New content forms are

emerging. From user generated

videos to short-form content to

metaverse, content creation is

seeing a wave of disruption.

![]() Network18 has been at the

vanguard of content evolution

in the country, continuously

experimenting and innovating new

concepts. Our teams keep their ears

close to the ground to understand

changing consumer preferences and

continuously adapt. From launching

Firstpost Vantage and Local18 for

digital-first audience to introducing

multi-cam feed for sporting events on

digital platform which gives audience

control of their viewing experience and

option to choose from 12-language

audio feed, innovation continues to be

the driving force.

Network18 has been at the

vanguard of content evolution

in the country, continuously

experimenting and innovating new

concepts. Our teams keep their ears

close to the ground to understand

changing consumer preferences and

continuously adapt. From launching

Firstpost Vantage and Local18 for

digital-first audience to introducing

multi-cam feed for sporting events on

digital platform which gives audience

control of their viewing experience and

option to choose from 12-language

audio feed, innovation continues to be

the driving force.

![]() Megatrend

Megatrend

![]() Business response

Business response

STRATEGIC PRIORITIES AND PROGRESS

Continue to Strengthen ‘Digital First,

TV Always’ Proposition

Progress in FY 2022-23

- News business continued to improve its digital first approach with newsroom integration, revamped workflow, organisational redesign and scaling up of tech capabilities.

- New features launched on digital platform for sporting events, to give viewers a unique viewing experience.

Medium-term Priorities

- Provide a seamless experience to the user, irrespective of the platform.

- Complement the ‘mass’ nature of TV viewing with the ‘personalisation’ experience of digital.

Strengthen Position in

Regional Markets

Progress in FY 2022-23

- TV News network became leader in several Hindi‑speaking regional markets.

- Network18’s vernacular digital portfolio became #1 in the country.

- Entertainment network gained traction in select regional markets.

Medium-term Priorities

- Become a true pan-India player with strong positions in markets across the country.

- Establish strong vernacular presence on digital platforms.

- Leverage learnings from one market to replicate success in others.

Build Sustainable and Scalable Business

Model for Digital Products

Progress in FY 2022-23

- Sports content made available free on AVOD model, driving record-breaking reach and scale.

- Subscription products – Voot Select and MC Pro continued to gain subscriber base.

Medium-term Priorities

- Leverage both AVOD and SVOD opportunities to drive growth.

- Evaluate opportunities to create new monetisation streams.

- Digital contribution to revenue to grow to 50%.

Continue Innovation and Expansion into

New Content Genres

Progress in FY 2022-23

- Firstpost Vantage, a digital-first show, gives audience global stories with an Indian perspective.

- Local18 curates hyperlocal news for audience across the country.

Medium-term Priorities

- Be the go-to destination for diverse demographic and socio-economic audience segments for content across genres.

PERFORMANCE UPDATE

The business navigated economic headwinds and a soft advertising environment to deliver 5.8% growth in operating revenue, driven primarily by Sports and Movie verticals. Despite a strong operating performance, revenue in the core segments was subdued. The business made substantial investments in Sports and Digital segments, which impacted the profitability.

Jio Studios, the media and content arm of RIL, is a leading content studio that produces movies and web originals in Hindi and all other major Indian languages. Achieving market leadership within five years of its inception, Jio Studios has demonstrated scale, commercial success as well as garnered critical acclaim with 16 films and 8 web series sweeping over 100 awards in India and internationally. Jio Studios takes its stories to viewers via theatres, as well as broadcast television and digital OTT platforms and has been instrumental in powering the entertainment launch of Jio Cinema post IPL.

The ‘Jiofication’ moment of the content industry occurred when the studio for the first time unveiled its spectacular content slate in April 2023, the single largest slate ever produced by an Indian studio in any given year. It has lined up ready to release over 100+ stories across genres of films and original web series in multiple languages including Hindi, Marathi, Bengali, Gujarati, South and Bhojpuri, capturing every emotion and genre of storytelling - Action, Drama, Thriller, Comedy, Romance, Biopics, Horror, Musicals et al.

In a largely fragmented industry, the depth and width of this marquee offering promises to be a game-changer in the world of Indian entertainment, delivering high quality content that is both entertaining and thought provoking. This has been achieved through meticulous collaboration with some of the best creative minds in the country.

Jio Studios’ vision is to power stories for India and Bharat, that not only entertain but also have purpose, to partner with storytellers in every Indian language and take these stories mainstream. Its mission to 'Make in India and Show the World' is vast and inclusive.

As the Media & Entertainment sector is expected to grow

at a

CAGR

of 10.5% to

reach

`2.83 trillion by 2025, Jio Studios aspires to lead from the front as a gamechanger in the

content creation value chain with respect to scalability, technology, and creative excellence to put

Indian stories on the global map.

Winning Laurels

Vikram Vedha

IIFA — Best Leading Actor, Male

Bhediya

Zee Cine Awards 2023

- Most Streamed Album of the Year

- Performer of the year 2023, Actor

Dasvi

OTTplay App Awards (Best Web Original Film — Jury Award)

Mi Vasantrao

National Awards — Best Singer

Dekhta Ja India

BUSINESS PERFORMANCE

News Business

TV News

Business News

Our Business News portfolio, comprising of CNBC TV18, CNBC Awaaz, and CNBC Bajar, continued to be the leader in the market, offering a 3600 coverage of business and financial news, deep analysis of daily events, interviews with eminent industry leaders and a global perspective on important events.

General News

CNN News18 (English) and News18 India (Hindi) rose to leadership during the year amidst a highly competitive environment, driven by their in‑depth coverage of national, local, and international events. CNN News18, with a panel of award-winning journalists, has been a thought leader all along and has pioneered several path breaking initiatives. News18 India’s strong, purposeful reportage of key issues and substantive journalism typified by constructive criticism have been the key drivers of its ascent to leadership.

Regional News

The regional portfolio, with 1,000+ reporters stationed in virtually every corner of the nation, covers 26 states in 16 languages and caters to 60 million viewers across India. 5 of the 14 regional news channels were leaders in their markets.

#1

CHANNELS IN HINDI, ENGLISH AND ENGLISH BUSINESS NEWS GENRESDigital News

Networks18’s digital news portfolio, consisting of Moneycontrol and News18.com (across 13 languages), continued to be India’s #2 online publisher attaining leadership in the non-English segment. ‘Firstpost Vantage’, a digital-first show, helped the brand gain ~1mn subscribers on YouTube, while CNN News18’s YouTube channel was #1 amongst all the English news channels. MoneyControl Pro continued to see growth in pay subscriber base, driven by its cutting-edge tools, research and exclusive content.

Entertainment Business

TV Entertainment

Hindi General Entertainment

Colors increased its market share across prime time and full day to strengthen its #2 position in the genre, driven by a programming mix of fiction shows and popular reality shows. FTA channel, Colors Rishtey, witnessed a decrease in viewership after its exit from DD FreeDish platform in April 2022.

Hindi Movies

Colors Cineplex, the pay movie channel, increased its market share during the year, driven by more than 20 World Television Premieres. FTA movie channels, Colors Cineplex Superhit and Colors Cineplex Bollywood, helped the network maintain a strong position in the free-to-air genre.

Music and Youth

MTV continued to be a strong brand in the Youth category and MTV Beats maintained its position amongst the top music channels in India.

English Entertainment

Viacom18 continues to be the undisputed leader in the English genre, with a combined viewership share of 95%+.

Kids Entertainment

India’s leading portfolio of Kids’ entertainment channels commanded a 30%+ market share with Nickelodeon being the #1 channel for over 9 years.

Regional Entertainment

In the regional entertainment bouquet,

Colors Kannada maintained a strong

#2 position through the year and

Colors Marathi exited the year as the

#2 channel. Other channels in the

portfolio include Colors Bangla, Colors

Oriya, Colors Gujarati, Colors Tamil,

Colors Super (Kannada), and the movie

channels – Colors Kannada Cinema,

Gujarati Cinema and Bangla Cinema.

Infotainment channel, History

TV18, continued to be amongst

the top 2 channels in the genre in

urban markets.

Digital Entertainment

OTT platform, Voot, continued to be

one of India’s highest engagement

platform and was the #2 broadcaster-

OTT in terms of time spent per day.

JioCinema established itself as a

destination for premium Sports content

with streaming of IPL, FIFA World Cup

and Women Premier League.

The platform set new benchmarks of

scale and engagement with its wide

reach and unique features.

Live Events and Ticketing business,

Bookmyshow, delivered a sharp

improvement in operating and financial

performance after the impact of

pandemic on the business for almost

two years.

Film Business

Viacom18 Studios

As the impact of COVID-19 on the movie industry receded, Viacom18 Studios ramped up its slate and released several movies during the year. Some of the notable movies released during the year were Laal Singh Chaddha, Jugjugg Jeeyo, and Shabaash Mithu.

Print/Publishing Business

Portfolio comprises of print and online versions of Forbes, Better Photography and Overdrive, each one of them, a leader in their own category, and continuously striving to achieve new heights.

CSR INITIATIVES

At Network18, Corporate Social Responsibility (CSR) is embedded in its long-term business strategy. Network18’s community initiatives help elevate the quality of life of millions, especially the disadvantaged sections of society.

Mission Swacchta Aur Paani

The latest season of Network18’s largest initiative, Mission Paani, pivoted to Mission Swachhta Aur Paani. Stories of water conservation, hygiene and sanitation took centre stage throughout the season, focusing on the great precedence being set by the North-eastern states. These stories were amplified across our TV, Digital and Social media platforms. The initiative upheld the cause of inclusive sanitation where everyone has access to clean toilets, culminating with an 8-hour long telethon on World Toilet Day to mobilise Indians for better sanitation.

Future. Female. Forward. – The Women’s Collective

CNBC TV18 embarked on a new journey, charting a path of gender parity, focusing on the status of women representation across industries and sectors and celebrating the women champions across different spheres. The theme of making gender parity an inevitable reality was taken to the WEF’23 in Davos, where leaders from across the globe wore FFF batches as a token of support for the cause. In March 2023, one of the biggest summits on gender parity was organised, mobilising leaders from across industries.

Sadak Suraksha Abhiyaan

An initiative in partnership with the Ministry of Road Transport and Highways to educate the masses and inculcate a sense of responsibility towards creating safe roads. A comprehensive campaign on raising awareness around these issues concluded with a four-hour special telethon in the presence of Hon’ble minister Nitin Gadkari, highlighting the importance of ‘Safe Roads’ for the world’s fastest growing economy.

OUTLOOK

We firmly believe in the long-term growth potential of the Indian M&E industry as it has a significant room for growth, in terms of penetration as well as monetisation.

India stands out from other countries due to it’s linguistic diversity, creating a distinct landscape that necessitates presence across various languages to establish a nationwide presence. Despite the unique characteristics of each of these markets, an ever-increasing appetite for quality content remains a constant theme throughout the country.

Digital penetration has unlocked a great opportunity to reach masses with on demand content and a fast-growing adoption of connected TVs presents an opportunity to reach premium audience at scale. We are committed to make investments across our businesses, to make them the default platform of choice for consumers seeking diverse, quality content. This will not only help us to achieve a commanding operating position, but will also help us to leverage future growth opportunities.